At the beginning of this year, the Zakat, Tax, and Customs Authority (ZATCA), formerly known as the General Authority of Tax and Zakat (GAZT), announced their new e-invoicing (Fatoorah) regulation. We are glad to provide you with more information and updates on the regulation’s implementation phases and updates.

The E-Invoicing (FATOORAH) initiative is considered one of the most important initiatives in Saudi Arabia, creating a major positive impact on the country’s economy. This initiative aims to dissolve the shadow economy, facilitate tax returns, adopt international standards, improve the kingdom’s global ranking, and promote fair business competition as well as consumer protection.

The Essentials

According to ZATCA’s new regulation, an e-invoice (Fatoorah) is simply an electronic invoice that can be generated and archived in a tamper-proof system. The new e-invoicing regulation essentially means that manual paper invoices will soon be considered invalid.

Saudi’s ambitious goal for e-invoicing will be split into two main phases. The first phase mandates to prepare and implement systems that allow them to generate, archive e-invoices. The deadline for this first phase is December 4th 2021. The second phase, with January 2023 as its starting point, is the implementation phase – where e-invoicing systems must be seamlessly integrated with the ZATCA platform.

Generation - The First Phase

The first phase is the Generation phase. This period gives time for all taxpayers to abide by the e-invoicing requirements to start adopting systems to issue and archive e-invoices in a structured and secure manner if they have not already.

Technical Requirements

Saudi's ambitious goal requires that businesses adhere to specific technical requirements so that there are no cybersecurity, fraud, and integration issues. Technical rules such as internet access, electronic systems, and structured invoice content ensure that the e-invoicing process aims to eliminate any manual intervention or tampering; and allows for clear generation and validation of e-invoices.

E-invoice (Fatoorah) structure

In addition to the mandatory e-invoicing fields, the following fields will be required as of 4th December 2021:

- QR codes (Optional for B2B)

- Digital Signatures

- UUID (Integration Phase)

These new fields along with all the mandatory VAT invoice information must be available through a QR code to provide with the system the security it needs in the initial phase. Everything mentioned above creates an initial structured and secure system for e-invoicing. But real security and control can only be achieved once individual e-invoicing systems are integrated with the ZATCA e-invoicing platform.

Integration – The Second Phase

The second phase is the integration phase, which aims to help all individual systems seamlessly integrate with the ZATCA e-invoicing platform via APIs.

E-Invoice (Fatoorah) Generation and Processing

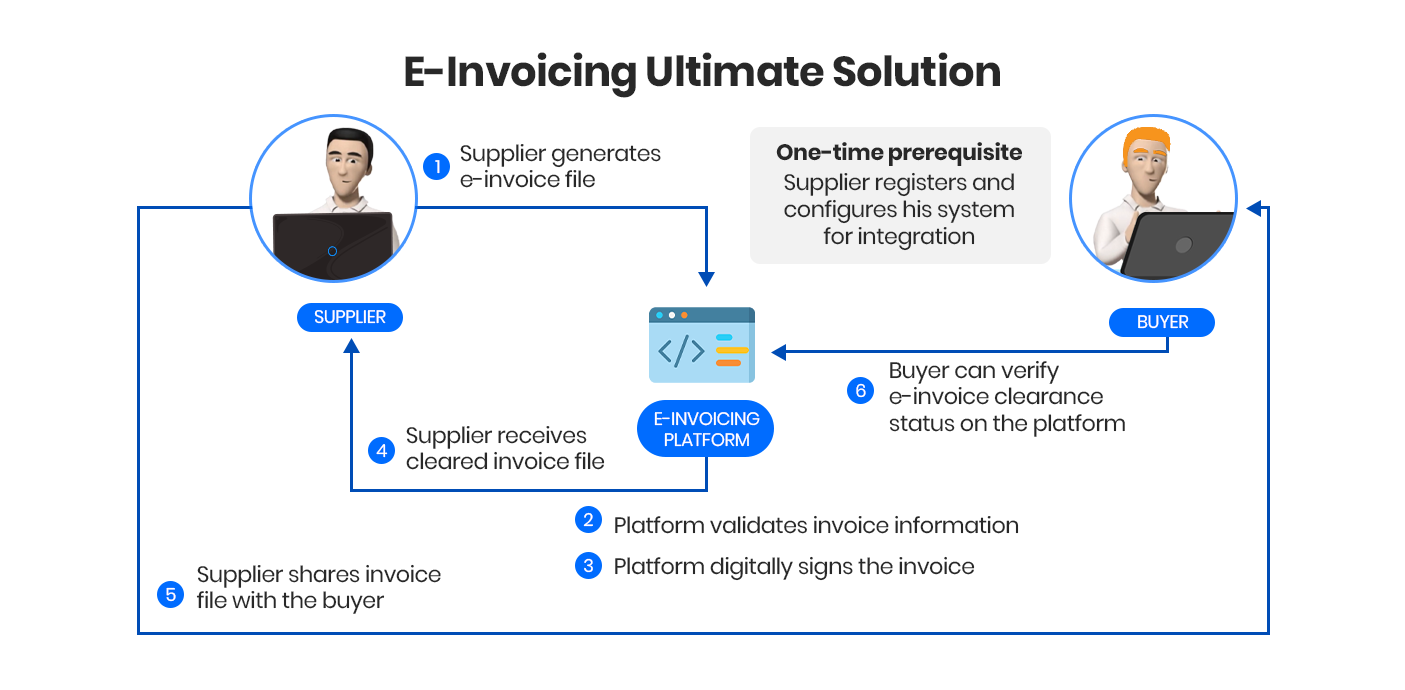

Once all these requirements are implemented, it should allow users to check and verify e-invoices in real-time through an online portal developed by ZATCA. The verification system is shown below:

As you can see, the benefit of integration allows a real-time verification of e-invoices for suppliers as well as buyers. Along with real-time verification, the ZATCA e-invoicing platform serves as a secure checking point for e-invoice issuance.

What steps should you take next?

E-invoicing is not a hurdle but a facilitator to boost your business. Automating your financials is a big step in accelerating your business's growth and is now a mandatory one for Saudi Arabia. Businesses around the world, small and large, are realizing the benefits of digitization. SAP business applications including SAP Business One, SAP Business ByDesign, and RISE with SAP are the most comprehensive systems for digitizing and streamlining all your business operations, but digitizing is not the only goal you should have in mind. Seamlessly collaborating with internal and external ecosystems to efficiently generate e-invoices is crucial to be ready for the new mandate.

Our comprehensive tailor-made solutions, 800+ global SAP deployments, and top-tier strategic partnerships will prepare your business for the new e-invoicing regulation while also providing you with the competitive edge needed to grow in today’s economy. So, what are you waiting for? December 2021 is around the corner, and it's never too early to prepare.

Start e-invoicing today!

Contact us to learn how we help businesses prepare for mandatory e-invoicing.

Comments (1)